Add a loan to my budget

A loan is typically received from an external source that provides funding. You can add a loan to your budget using the Loan template. All you need to do is complete the terms of the loan and the impact to your budget is automatically calculated.

Add a loan with the template

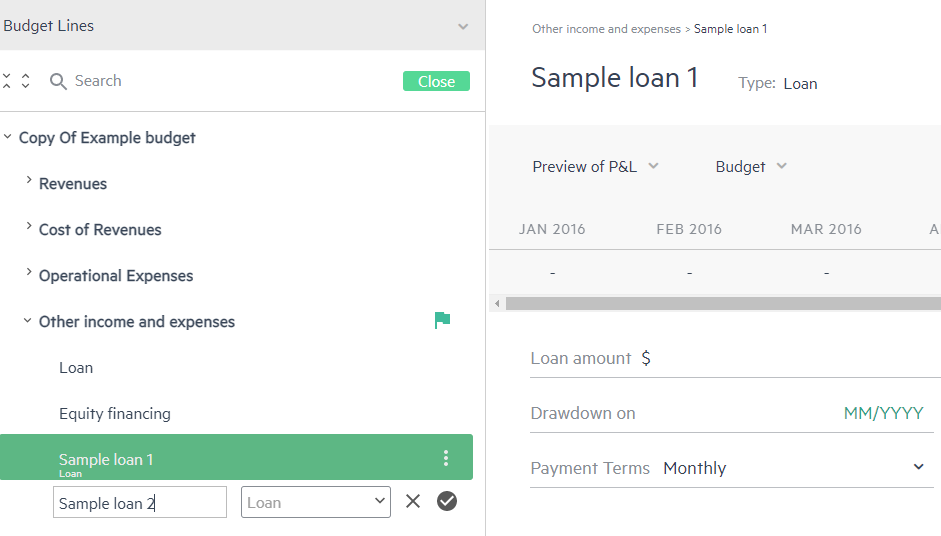

To add a loan to your budget:

-

From the Other income and expenses group in the budget tree, click the plus sign

to add a new budget line.

to add a new budget line. -

Add a descriptive name to the budget line and choose the Loan type from the dropdown. The Loan template is displayed.

-

Click

or type Enter to add the budget line.

or type Enter to add the budget line. -

Enter the loan details and click Save.

From the dropdown list, you can preview the impact of the loan by switching between Preview of Cash and Preview of P&L.

In addition to the standard fields, the following fields are unique to the Loan template:

| Field | Description |

|---|---|

|

Loan amount |

The principle amount of the loan |

|

Method |

The manner of paying back the loan |

|

Options |

Fixed installments/Interest only/Balloon/Fixed principal/Custom schedule |

|

Drawdown on |

The date on which you can access your funds |

|

Loan term |

The period of time in months in which a loan is repaid |

|

Interest rate |

The percentage of the loan charged as interest (or the cost of borrowing) to the borrower |

|

Payment terms |

When payments need to be made |

|

First principal payment |

After X months is when to start payment toward the amount of the principal owed Default: empty |

The method selected directly influences the fields displayed in the template. For example, if you already have a loan and the loan terms don't match any other method, you can select Custom schedule and enter the loan payment amounts every month. This option doesn't require that you know all of the loan details. Only the amounts you enter are used and no calculations are made.

View your loan in sheets

You can see the influence your loan budget line has on your Profit & Loss, Cash, and Balance sheet reports in the Sheets view:

-

Profit & Loss - Under the Other income and expenses group, the Loan budget line displays the monthly interest expense.

-

Cash - Under the Other income and expenses group, the loan payment amount appears at the time the loan was taken, or on the drawdown date. Your payment of the principal and interest can be at any time throughout the loan period, depending on the loan method you choose. For example, if you choose Fixed principal, you can decide after how many months you would like to pay the first principal payment and whether or not you want to pay monthly or quarterly.

-

Balance sheet - Depending on the number of months you define for the length of the loan term, the location of the Loan budget line in your Balance sheet report is different.

For short term loans:

-

The principal will be under Short term debt.

-

Any interest that isn't paid at the time the interest expense incurred, appears under Other current liabilities.

For long term loans:

-

The amount of the principal that is repaid in the short term period appears under Current portion of long term debt.

-

The amount of the principal that is not repaid in the short term period appears under Long term debt.

Any interest that isn't paid at the time the interest expense incurred, appears under:

-

Other current liabilities - for interest to be paid during short term.

-

Other long term liabilities - for interest to be paid during long term.

If you take a loan before the budget date range, the balance sheet displays your monthly change, but you do not see the balance of your loan. As such, it is recommended that at the beginning of each budget year, you update the budget beginning balances.

Is this helpful?

In this topic