Revenue budget lines types

Revenues are income before any costs or expenses are deducted. Revenues are generated from sales of the business's products or services. A basic revenue line consists of data such as the amount, date, and timing of cash received.

Planning provides you with a budget line type for a basic revenue entry called Revenues as well as other lines for common revenue types, such as Perpetual licenses, Services, Simple subscriptions, and Accounts receivable.

As with all budget line types, there is a Group type and a Revenue from model type. For more information about these general budget lines, see Create budget groups and Models.

Depending on the Spread you select, you can distribute the income in different ways across your budget period. For more information on how to spread out your costs, see Amortization of revenues and expenses.

The following sections provide a summary for each Revenue budget line type available in Planning.

Revenues

The basic Revenues budget line type can be used for any general revenue.

For example: a book store records the amount received for a book sale.

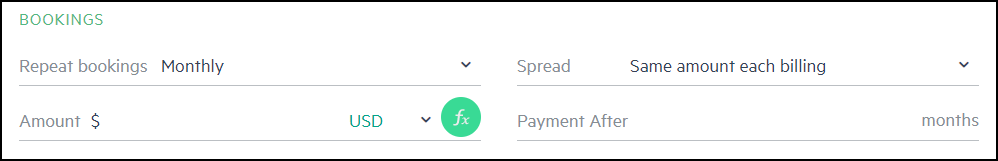

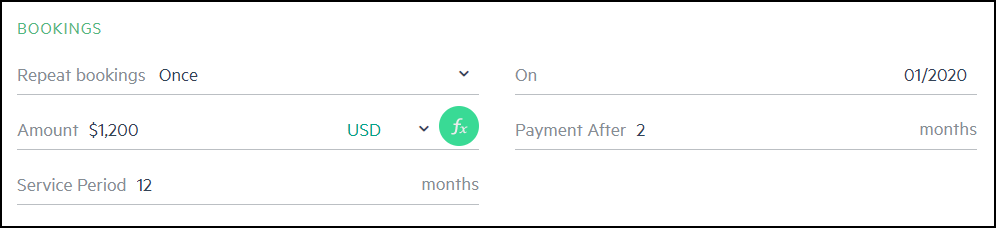

The template provides fields for the basic revenue options, such as Amount and Payment after options.

There are different types of Repeat bookings that can be set. If you select Once, then set the date On which the payment is due. Default: the first month of the Date Range. If you select Monthly, Quarterly, or Yearly, then set the type of Spread. Default: Same amount each billing.

Revenues data is recorded in Sheets as follows:

| Revenues | |

|---|---|

| Report | Recorded as |

| Cash flow sheet |

Cash Received for when the revenue has been received. |

|

P&L |

Revenues for when the revenue is invoiced. |

|

Balance Sheet |

Assets: Accounts receivable in the months when revenue is invoiced but not yet received. |

|

Assets: Cash in the months when the revenue has already been received. |

|

|

Retained earnings: Net P&L impact in the months when the revenue has been invoiced or paid. |

|

Perpetual license

The Perpetual license budget line type is used for purchases that offer continued use of a service, for a defined period of time. It also includes an option for providing support for an additional fee.

An example of a Perpetual license is providing access to software for a set amount of time. After it expires, the customer has the option to renew the license.

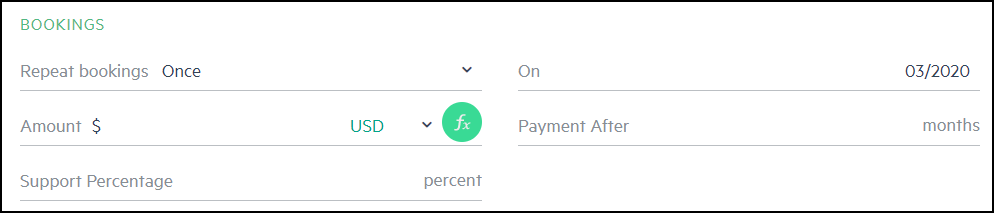

Fields available include the Amount, Payment After a set amount of months, and the Support Percentage.

There are different types of Repeat bookings that can be set. If you select Once, then set the date On which the payment is due. Default: the first month of the Date Range. If you select Monthly, Quarterly, or Yearly, then set the type of Spread. Default: Same amount each billing.

Perpetual license data is recorded in Sheets as follows:

| Perpetual license | |

|---|---|

| Report | Recorded as |

|

Cash flow sheet |

Cash Received for when the revenue has been received. |

|

P&L |

Revenues for when the revenue is invoiced. |

|

Balance Sheet |

Assets: Accounts receivable in the months when revenue is invoiced but not yet received. |

|

Assets: Cash in the months when the revenue has already been received. |

|

|

Retained earnings: Net P&L impact in the months when the revenue has been invoiced or paid. |

|

Simple subscription

Simple Subscriptions are contracts for paying a fee to receive a product or service in regular intervals. For example, a yearly magazine subscription for a magazine that is sent out once a week throughout the year.

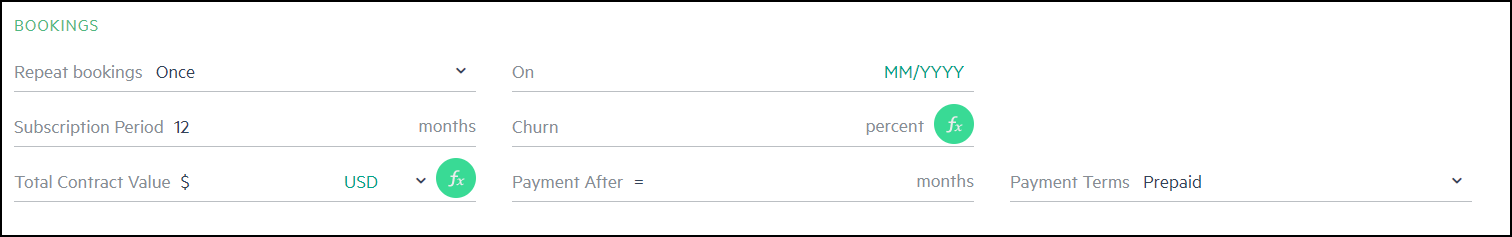

The template includes the Total Contract Value (the cost) the Subscription Period (in months), the option for Payment After a set amount of months, Payment Terms, and the Churn percentage.

There are different types of Repeat bookings that can be set. If you select Once, then set the date On which the payment is due. Default: the first month of the Date Range. If you select Monthly, Quarterly, or Yearly, then set the type of Spread. Default: Same amount each billing.

Simple subscription is recorded in Sheets as follows:

| Simple subscription | |

|---|---|

| Report | Recorded as |

|

Cash flow sheet |

Cash Received in the actual month that it is paid. |

|

P&L |

Revenues in the months that are invoiced and paid. |

|

Balance Sheet |

Assets: Cash for the months when and after payment received. |

|

Assets: Accounts receivable for the payment amount invoiced but not yet received. |

|

|

Liabilities: Deferred revenue for the amount received for months that were paid for but have not happened yet. Therefore, the service/product has not yet been delivered. (In our magazine subscription example, these are the months that were paid for but have not yet happened, and therefore the magazines were not yet delivered.) |

|

|

Liabilities: Retained earnings for the amount received for months that were paid for and have passed. Therefore, the service/product was delivered. (In our magazine subscription example, these are the months that were paid for, have happened, and magazines were delivered. |

|

SaaS subscription

The SaaS subscription budget lines are contracts for paying a fee to receive SaaS (Software as a Service) products for a set amount of time. For example, a yearly internet provider service contract.

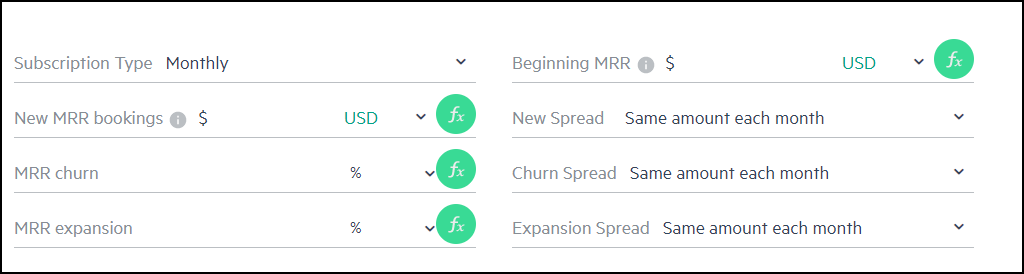

The template lets you calculate your subscription revenues according to either MRR or ARR by selecting either a Monthly or Annual Subscription Type. It includes the Beginning MRR/ARR and New MRR/ACV amounts, different Spread options, the Churn and Expansions percentages.

SaaS subscription data is recorded in Sheets as follows:

| SaaS subscription | |

|---|---|

| Report | Recorded as |

|

Cash flow sheet |

Cash Received: Total amount received each month. |

|

P&L |

Revenues: Total amount invoiced each month. |

|

Balance Sheet |

Assets: Cash Each month shows the total amount already received. |

|

Liabilities: Retained earnings Each month shows the total amount already invoiced and not yet received. |

|

Services

The Services budget line type is for intangible products such as accounting, banking, consultancy, or education. For example, a contract providing IT support for a year.

The template includes the Amount, an option to receive Payment After a set amount of months, and the Service Period.

There are different types of Repeat bookings that can be set. If you select Once, then set the date On which the payment is due. Default: the first month of the Date Range. If you select Monthly, Quarterly, or Yearly, then set the type of Spread. Default: Same amount each billing.

Services data is recorded in Sheets as follows:

| Services | |

|---|---|

| Report | Recorded as |

|

Cash flow sheet |

Cash Received in the actual month that it is paid. |

|

P&L |

Revenues in the months that are invoiced and paid. |

|

Balance Sheet |

Assets: Cash for the months when and after amount received. |

|

Assets: Accounts receivable for the payment amount invoiced but not yet received. |

|

|

Liabilities: Deferred revenue for the payment amount received for months that were paid for but have not happened yet. Therefore, the service still needs to be delivered in these months. |

|

|

Liabilities: Retained earnings for the payment amount received for months that were paid for and have passed. Therefore, the service has been delivered in these months. |

|

Revenue adjustment

The Revenue adjustment budget line type allows you to decrease your revenue budget and enter negative revenue amounts. For more information, see .

Deferred revenue (Past balances)

Deferred revenue is the income that your company receives in advance of earning it for services that have not yet been performed, or products that are still owed to a customer.

For example, a company receives money from a customer for a plane ticket for a future date.

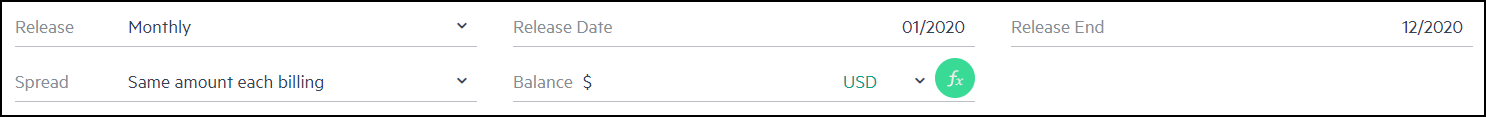

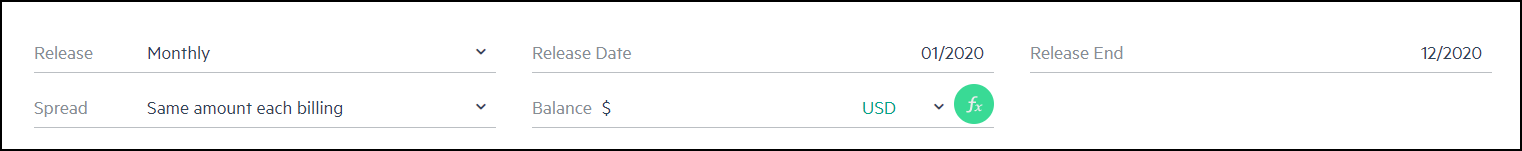

The template includes the Balance amount being received, the Release Date and Release End dates of when it is being received, and type of Release and Spread schedules.

Deferred revenue data is recorded in Sheets as follows:

| Deferred revenue | |

|---|---|

| Report | Recorded as |

|

Cash flow sheet |

Deferred revenue is not recorded since it has no financial impact. |

|

P&L |

Revenue |

|

Balance Sheet |

A Liability since the amount is a prepayment by the customer but the product or service is still owed to the customer. |

Accounts receivable (Past balances)

Accounts receivable is the balance of money due from customers, for products or services that have been invoiced but not yet paid. The cash account is debited against accounts receivables.

For example, a plumber fixes a sink and sends an invoice for the work that was done. Another example, a hardware store that sells tools to a customer with an invoice that can be paid within 90 days. In both of these examples, the amount of the invoice is listed in Accounts receivable. When the payment is made, the amount is in Accounts receivable goes down and the amount in the Cash budget line goes up.

The template includes the Balance amount being received, the Release Date and Release End dates of when it is being received, and the type of Release and Spread schedules.

Accounts receivable data is recorded in Sheets as follows:

| Accounts receivable | |

|---|---|

| Report | Recorded as |

|

Cash flow sheet |

A positive number which represents the use of cash, or a decline of cash flow in that amount. |

|

P&L |

Accounts receivable has no financial impact and is therefore not recorded. |

|

Balance Sheet |

A current asset since the amount owed by customers is made on credit. |

In this topic